Section 179 Tax Deduction

Build Your Business

Get The Most Out Of Your Investment

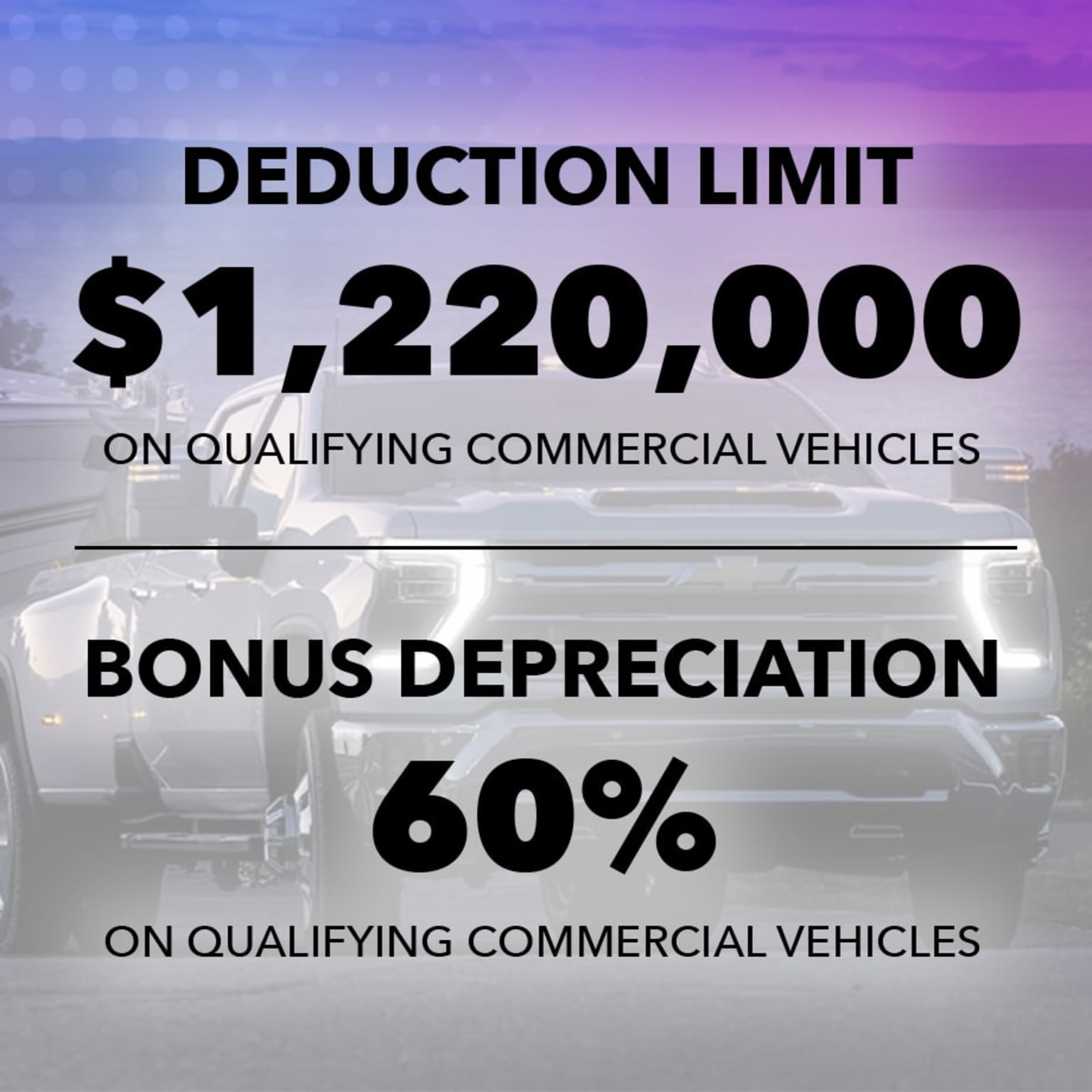

Your work vehicle takes care of business every day. It can also net you tax deductions at the end of the business year! Via the Internal Revenue Service’s Section 179 Tax Deduction, vehicles purchased during the tax year can be used to apply up to a $1,220,000 deductible,* with a purchase limit of $3,050,000 on vehicles and equipment.* Businesses can also write off 60% bonus depreciation on both new and pre-owned vehicles. The vehicle must be used for business purposes more than 50% of the time, and your business must provide proof of commercial usage to earn this significant tax break. Stop by one of the Aschenbach Automotive Group locations today to shop for your next commercial vehicle!

Why Buy From Aschenbach?

We want to be your go-to destination for all things automotive!

Aschenbach Knows Commercial

When you shop Aschenbach commercial, you’ll find the most rugged and dependable vehicles to add to your fleet. Browse the legendary Ford F-Series, Chevrolet Silverado models, sleek Buick SUVs, reliable Ram 1500s, or fuel-efficient Hyundai Hybrids. Our dealerships are markup-free, and we are here to ensure the best buying experience possible as you look to grow your business and your fleet of business vehicles. Stop by an Aschenbach Automotive Group dealership today!

Let's Get Started

Browse our commercial selection and take advantage of the Section 179 Tax Deduction.

How can we help?

Interested in expanding your fleet? Fill out the form and we will get back to you as soon as possible.

Or, if you’d prefer to reach us directly over the phone,

Click To Call Now: 443-537-1182

Our Locations

We have storefronts in Virginia, Maryland, Pennsylvania, and Florida and offer the full sales experience, including tags, title, and financing departments! All our locations have full-service departments and parts counters, so whatever you may need, we have! Aschenbach Automotive Group dealerships make it easy to schedule an appointment, service your car, purchase parts, and, most importantly, leave happy!

*See your tax professional for complete details.